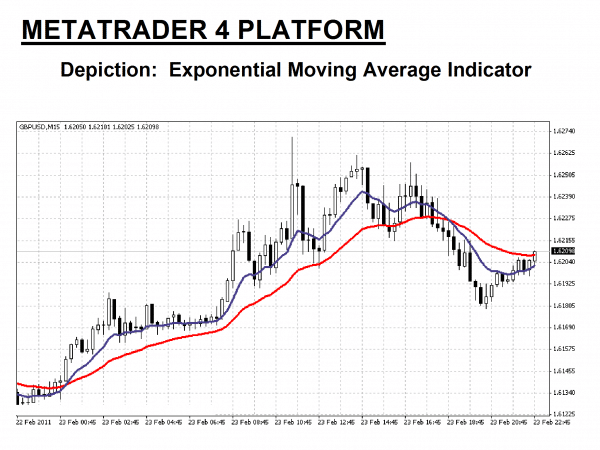

When the EMA is used with other indicators, the signals become more accurate and powerful. The following area of resistance also serves as a strong profiting zone.The exponential moving average gives us an idea of support and resistance. Therefore, the 1:3 ratio of risk to return can be considered for the exit plan. The 200 EMA, a long period EMA, serves as an excellent stop loss. After this indication, the price continues to rise.Īn ideal stop loss is situated below the previous low and immediately below the penetrating pattern. Therefore, whenever the indicator generates the buy signal, it is shown by a yellow-colored circle it shows that the five periods EMA has crossed the fifteen periods EMA in simpler words, the blue-colored line has crossed the red-colored line. Keep in mind that the trading price is beyond two hundred period EMA. While the fifteen periods EMA is represented using a red-colored line, a green-colored line represents a two hundred period EMA. Illustration in a chartĪ five-period EMA is pointed by a grey-colored arrow represented by a blue-colored line. After that, hold on until the five-period EMA enters the fifteen-period EMA line. The price must be hovering beyond the two hundred EMA line for purchase signals. You could, for example, incorporate the five, fifteen, and two hundred EMA intervals. For providing better signals, it combines three distinct periods. The indicator gives better results using triple EMA. Now, the question arises, what about the exit plan? First, you can consider keeping the EMA indicator at previous lower trade and profit during the following high trade or in the resistance zone. Similarly, a sell signal is formed when the lower EMA traverses the higher EMA from the top. A buying signal is formed when the lower EMA crosses the higher duration EMA underneath. This technique generally includes both up and down EMA periods, commonly nine and twenty-one EMA periods. The Crossover technique gives better trade signals.

In the same way, there is a downtrend in the market when the market price is under the EMA indicator line. When the market price advances beyond the EMA indicator line, it shows that an uptrend is in progress. To understand the overall market trend, you should also examine the EMA’s position. However, when there is a decrease in EMA, you should sell the trades. This explains that you should hold onto the positions when there is an increase in the EMA. An increasing EMA usually implies a bullish trade, while a dropping EMA indicates a bearish market action. The EMA – Exponential Moving Average indicator can be used in various ways.

Using the Exponential Moving Average Indicator in Trading For example, if the price is above EMA200 on the daily chart, we can tell that the daily trend is bullish, and usually, this indicator has a high impact on technical analysis. We need to understand the EMA indicator on the crypto-asset chart as a trend trading indicator. So, for example, if the price is above EMA200 on the daily chart, we can tell that the daily trend is bullish, and usually, this indicator has a high impact on technical analysis. EMA indicator you need to understand as classical trend indicator where above EMA line is a bullish trend and below EMA line is a bearish trend.

0 kommentar(er)

0 kommentar(er)